Two recent British Columbia decisions Kriegman v Dill 2018 BCCA 86 and Boale Wood & Co Ltd v Whitmore 2017 BCSC 1917 have dealt with various legal aspects arising out of Ponzi schemes.

The growth of international commerce has given rise to cross-border fraud schemes that are increasingly coming before the courts.

The Boale case involved a notary, who was instrumental in setting up a $100 million Ponzi scheme where most of the participants lost considerable sums of money.

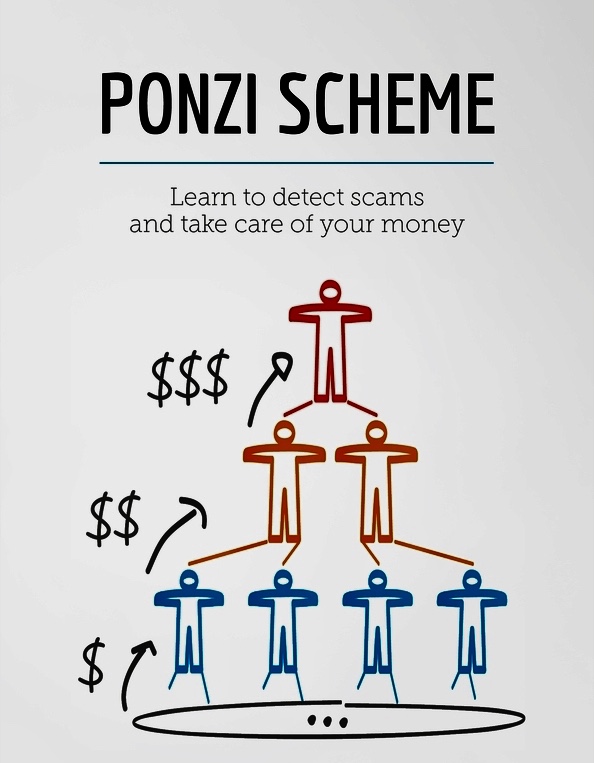

In Boale Wood and CO Ltd v Whitmore 2017 BCSC 1917, the court adopted the United States Securities and Exchange Commission definition of a Ponzi scheme as:

“an investment fraud that involves the payment of purported returns to existing investors from funds contributed by new investors. Ponzi scheme organizers often solicit new investors by promising to invest funds in opportunities claim to generate high returns with little or no risk. In many Ponzi schemes, the fraudsters focus on attracting new money to make promised payments to earlier stage investors and to use for personal expenses, instead of engaging in any legitimate investment activity.”

The Ponzi scheme typically is a fraudulent investment in which money contributed by later investors generates artificially high dividends for the original investors, whose example attract even larger investments. Money from the new investors is used directly to repay, or pay interest to old investors, usually without any operation or revenue producing activity other than the continual raising of new funds.

Most Ponzi schemes come to court after the scheme has collapsed and the creditors seek recovery under bankruptcy legislation or provincial legislation dealing with fraudulent conveyances or preferences. The Kriegman v. Dill decision involved a bankruptcy, while the Boale Wood decision involved the Fraudulent Conveyance act and the Fraudulent Preference act , and adopted the reasoning of Titan investments Limited Partnership, 2005 A.B.Q.B 637 that a Ponzi scheme is insolvent from its commencement.

There is a large body of case law in the United States concerning Ponzi schemes, where U.S. Bankruptcy Court’s have exercised their equitable jurisdiction to bring together all of the entities, whether insolvent or not, that have participated in gathering funds from investors, consolidate those funds into one pool, and apply equitable subordination to permit all creditors to share the monies equitably. The goal is to distribute the wrongly obtained gains to all creditors of the scheme. The lucky early investors are obliged to share with the unlucky later investors in the scheme.

In Canada, there are no specific prohibitions in the securities legislation of the provinces and in the criminal code that address such Ponzi schemes specifically. Such scheme however, typically contravene the Securities act such as in British Columbia for example, that provides in section 57 that a person must not, directly or indirectly, engaging or participate in conduct relating to securities or exchange contracts of the person knows, or reasonably should know, that the conduct results in our contributes to a misleading appearance of trading activity in, or an artificial price for a security or exchange contract, or perpetrates a fraud on any person.

The criminal code of Canada also contains a general fraud offense at section 380.